2022 was a year of upheaval: rising energy, rising inflation, and the end of ‘easy money’. In the midst of all this, gold looks to be gathering momentum: in December alone the price of gold rose by 5%. Gold may not be the answer to all of 2023’s problems but it’s got quite a few of them squared away.

In prosaic terms, gold is no more than a soft metal, a chemical element with the atomic number 79 and symbol ‘Au’. It is quite rare, usually found as nuggets, or in rocks, veins and alluvial deposits. Its qualities as a metal do offer some practical benefits: it is resistant to acids, is easily alloyed with other metals like copper, and is used in various industrial contexts, like electronics, space technology, medicine and even cuisine.

However, it is not those qualities that have given it so much prominence in human history. For millennia, it has been its shimmering lustre that has caught our eye and fired our imagination. When alloyed with other metals it has also given us an amazing range of shades from Florentine and Renaissance, to White and the much-loved Rose gold.

Not only has its hue captivated us, but its malleability, the most supple of all metals, has allowed our craftsmen to turn it into astonishing objects of art and beauty. Some we have worn with pride, others we have gawped at in wonder and a few have even been venerated as sacred. Gold’s splendour has led us to prize it above other metals.

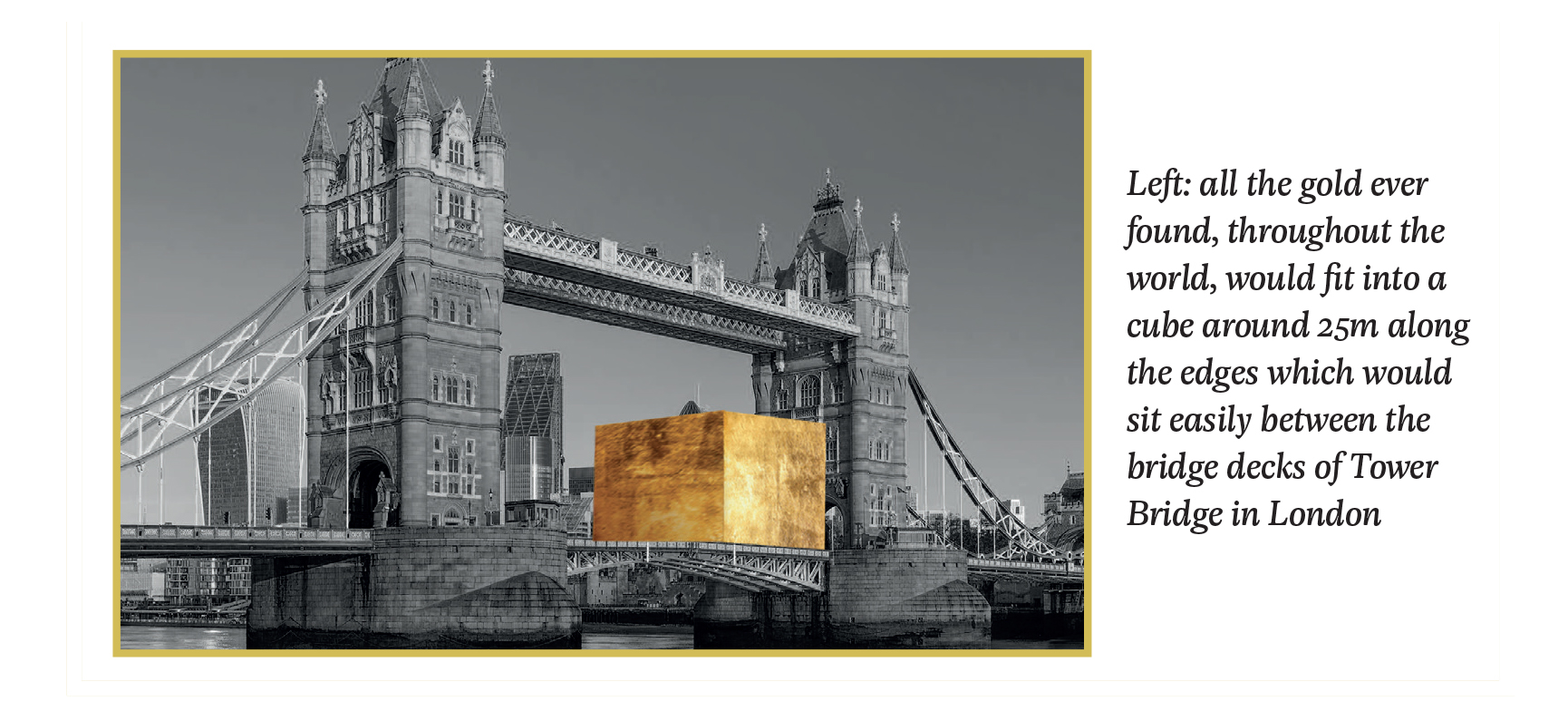

We then turn to its rarity, and this is perhaps where gold truly differentiates itself from other metals. Experts estimate there are around 310,000 tonnes of refined gold in existence. That’s the equivalent of a cube around 25 metres along each edge.

Putting this into context, this means all the gold ever found, throughout the world, would fit into a cube that’s the length of a tennis court. The cube would sit easily between the bridge decks of Tower Bridge in London. Gold is one of the rarest metals on planet Earth.

Its use in the production of coinage dates back to the seventh century BC in Asia Minor. It then spread to the Aegean. The earliest example, on display in the Bibliothèque Nationale in Paris, is an electrum (a naturally occurring alloy of gold and silver) stater, minted on the Greek island of Aegina at some point in the seventh century BC. For many centuries though, its rarity meant that it was used for ‘prestige money’ used mainly by the very wealthy. Everyday coinage was usually produced from silver, copper and/or bronze. Then as the Middle Ages gave way to the Renaissance and in turn the Age of Exploration, gold became a greater part of the currencies of most nations. By the early 19th century there was a shift wholly to gold as most nations in Europe, led by Britain, adopted a Gold Standard basing their currency solely on gold.

The First World War brought an end to the use of gold coinage in circulation, but most countries still held gold reserves to back their currency, and gold remained the basis of the international monetary system from the late 1920s to 1932 and again from 1944 until 1971, when the United States abandoned the convertibility of the US dollar to gold.

Over time, the price of gold has fluctuated, but has in general increased in value. The price is determined by a subtle mix of shrewd pragmatic analysis and emotive human psychology.

During times of war or political crisis, the price of gold increases as national currencies weaken, and people turn to the far more tangible safe haven of gold. The reverse is also the case. During times of growth and prosperity, the price of gold can suffer downwards pressure as people see less need for ‘a safe haven’.

Recently, the Russian invasion of Ukraine has been a case in point. As Russian troops invaded Ukraine in February 2022, gold reached $1,974 per ounce, the highest it had been since September 2020. However, before the Ukrainian crisis, the gold price was hovering around the $1,800 per ounce mark, having not made much progress since late 2020. Central Banks have been buying gold recently, buying more in Q3 of 2022 than in any annual quarter before. Their total holdings are now the highest they’ve been since 1974. It begs the question: do they know something that we don’t?#

Throughout history there have been many examples of currencies under severe stress, or of them collapsing altogether. On the other hand, despite some variations in price, gold has always been a safe haven of wealth. Moreover, all evidence suggests that gold will remain as the most secure deposit of value for a long time to come.

[Gold data accurate as of 15th January 2023]

How Hattons of London can help

With many investors and Central Banks seeking out the benefits of gold, you too may decide that you’d like to own more of it. With the gold price where it is, not only is demand for gold increasing but many of those who hold gold are choosing not to sell. The result is that we are noticing shortages on many sought-after gold coins.

Two ounces, five ounces, ten ounces… even one kilo gold coins are available to you.

Our stock of available coins is always changing but it usually includes limited edition gold sovereign coins from just £69 upwards. If you’d like to acquire a larger amount of gold then some of the coins we have include two ounces, five ounces, ten ounces, and even one kilo of gold. These coins have a ‘double dynamic’ bundling together the safety of a gold holding with the potential of a limited edition collector’s item.

To acquire more gold now, contact your Account Manager on 0800 954 1064. The call is free to you, so you can explain to your Account Manager what type of gold coins interest you, and they in turn can suggest some gold for your consideration. Now may prove to be the best time in 2023 to buy gold, and it may be much easier to do so than you think.

To acquire more gold now, contact your Account Manager on 0800 954 1064. The call is free to you, so you can explain to your Account Manager what type of gold coins interest you, and they in turn can suggest some gold for your consideration. Now may prove to be the best time in 2023 to buy gold, and it may be much easier to do so than you think.

We are not investment advisors and cannot predict the future, all of our advice provided is based on historical facts and the current market demands.